Calculate stock roi

Thus you will find the ROI formula helpful when you are going to make a financial decision. Figuring out what portion of.

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Write a formula where p equals price and q equals demand in the number of units.

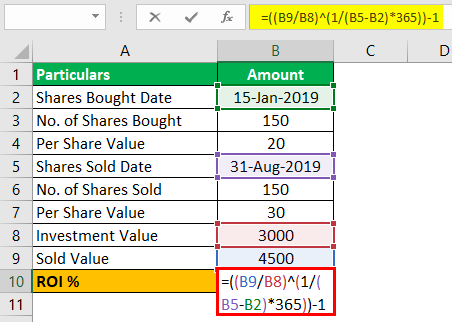

. For example an investor buys a stock on January 1st 2017 for 1250 and sells it on August 24 2017. The cap rate calculator alternatively called the capitalization rate calculator is a tool for everyone interested in real estateAs the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting itYou can use it to decide whether a propertys price is justified or determine the selling price of a property you own. This becomes especially important if you are considering a sale or merger or attempting to expand with help from a loan or outside investors.

Net benefit or loss generated by new equipment Total new equipment cost x 100. Badgers ROI reaches far beyond lost revenue from out-of-stock planogram compliance and price integrity. The ROI formula for equipment purchases is as follows.

Return on investment ROI is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. To calculate your net profit subtract your stocks current value from the initial investment price. For one calculating ROI for marketing can be tricky depending on how you measure impact and costs.

Our clients report a material reduction in claims lower insurance premiums and improved customer experience with Badgers hazard mitigation solution. It is most commonly measured as net income divided by the original capital cost of the investment. Now that Jamila understands which investment instrument presents the lowest risk-to-return ratio she can choose the most suitable option to meet her financial goals.

Since the coupon rate Coupon Rate The coupon rate is the ROI rate of interest paid on the bonds face value by the bonds issuers. There are a few challenges with calculating return on marketing investments this way. However as a general rule livable square footage refers to usable heated spaces in a property.

Jamila compares the bond and stock investments and finds that the bond investment CV of 20 indicates a lower risk-to-return ratio than the stocks potential CV of 38. Finally its time to calculate your total expected return. Simple Return on Investment ROI formula.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. Say an individual with an investment portfolio of 25 stocks wants to calculate the overall growth of his portfolio over the course of a year. Lets say you bought 5000 worth of stock in a.

ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. Calculate your annual and net savings when Badger Technologies autonomous robots. Coupon Rate Annualized Interest Payment Par Value of Bond 100 read more is lower than the YTM the bond price is less than the face value and as.

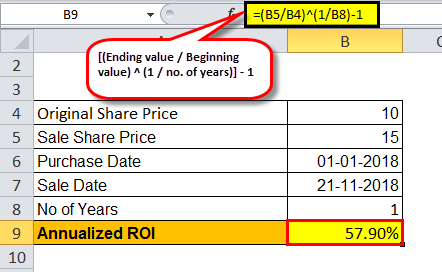

You can use formulas for sales and demand to predict the maximum revenue that a company can expect to make. Answers the question If I invest 10000 on Feb 15th and I get back 12850 on Aug. ROI measures the amount of.

20th what was my rate of return on an annual basis. To calculate your ROI divide the net profit from your investment by the investments initial cost then multiply the total by 100 to get a percentage. This Running Pace Calculator enables you to determine your running pace swiftly and with ease whether you are running for pleasure or training for a half-marathon marathon or other event.

A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. Learning how to calculate the square feet of a house can be a challenging task. Calculate an annulized ROI between any two dates.

You can repeat this process for each investment always dividing by the value entered in cell A2. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Entering this formula will calculate the weight of the investment you placed in row 2.

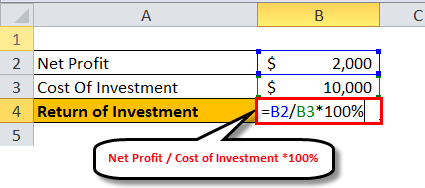

If spending 50000 on advertising generated 750000 in sales the business owner would be getting. ROI - Practical Examples ROI Formula. ROI net profit investment cost x 100.

He also invested 2000 in the shoe business in 2015 and sold his stock in 2016 at 2800. So through ROI one can calculate the best investment option available. To demonstrate that your brands valuation is accurate and.

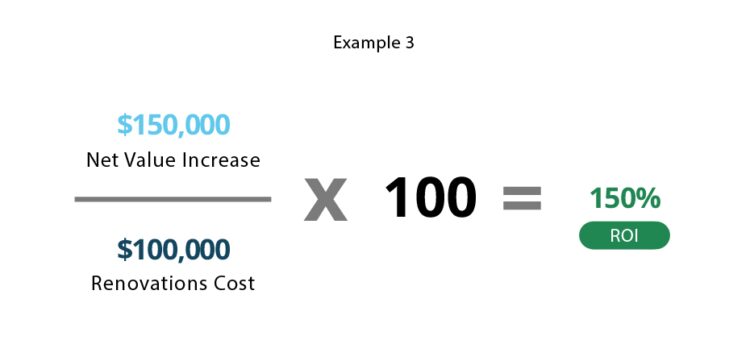

Return on investment ROI measures how effectively a business uses its capital to generate profit. The different methods used to calculate brand value means companies can manipulate the value of their brand equity to work in their favor. Return on investment is a ratio that evaluates how efficient a certain investment isIt is the obligatory starting and finishing point for any ambitious investor as it presents the potential of a future deal and the end results of a finished one in simple numbers.

The standard answer to how to calculate ROI is a formula. Return On Investment - ROI. He invested a total of 10000 in January and his portfolio is worth 11000 on December 31.

Attributable Sales Growth - Marketing Cost Marketing Cost ROI. To calculate maximum revenue determine the revenue function and then find its maximum value. A standard definition of ROI is the ratio of a benefit or loss made in a fiscal year expressed in terms of an investment and shown as a percentage.

A business owner could use ROI to calculate the return on the cost of advertising for instance. If a stock has seen a dramatic price decline and its dividend hasnt been cut yet the yield can appear high. It determines the repayment amount made by GIS guaranteed income security.

But if the work shift spans noon or midnight simple. Consider a company that pays a 2 annual dividend per share with a stock price of 60. Keep this in mind as you calculate your houses square feet and ask a realtor or appraiser if you are unsure of your estimates.

ROI is a much simpler formula used to calculate the profitability of an investment. Use the calculator to figure out your pace per yard mile meter or kilometer and view your splits in any of distance measurement. For example you could write something like p 500 - 150q.

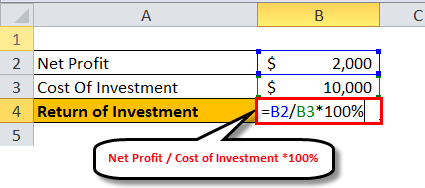

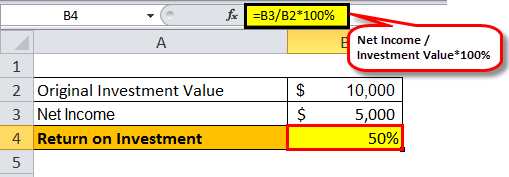

Then ROI Formula will be as follows-ROI Shoes_Business 2800-2000 100 2000 40. Our return on investment calculator can also be used to compare the efficiency of a few investments. Starting in cell E2 enter the formula C2A2.

We can see that investors book more profit in the business of Shoes as the return on. How to calculate ROI Return on Investment Calculating annualized return. The higher the ROI the better.

To calculate in Excel how many hours someone has worked you can often subtract the start time from the end time to get the difference. ROI calculator is a kind of investment calculator that enables you to estimate the profit or loss on your investment. Now calculate the buy or sell price needed to meet goal ROI.

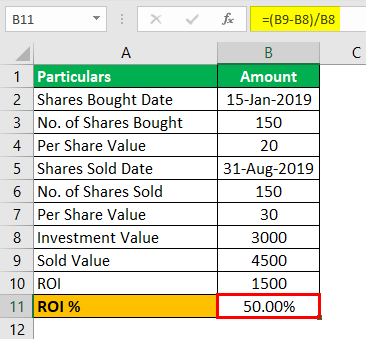

Calculating Return On Investment Roi In Excel

Calculating Return On Investment Roi In Excel

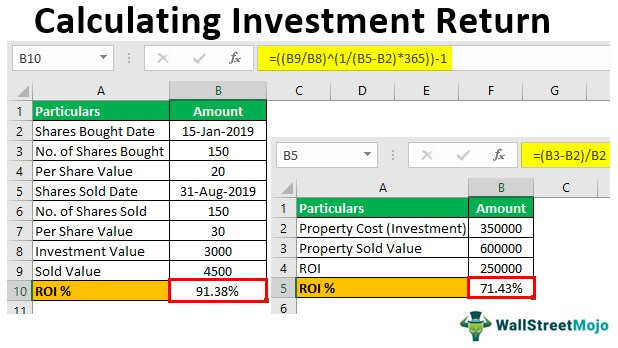

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Definition Formula Roi Calculation

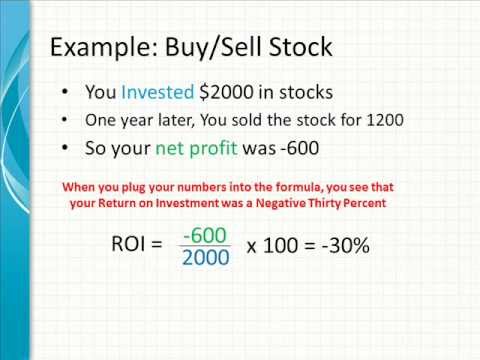

How To Calculate Roi Youtube

Calculating Investment Return In Excel Step By Step Examples

Total Stock Return Formula With Calculator

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Definition Equation How To Calculate It

Calculating Investment Return In Excel Step By Step Examples

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

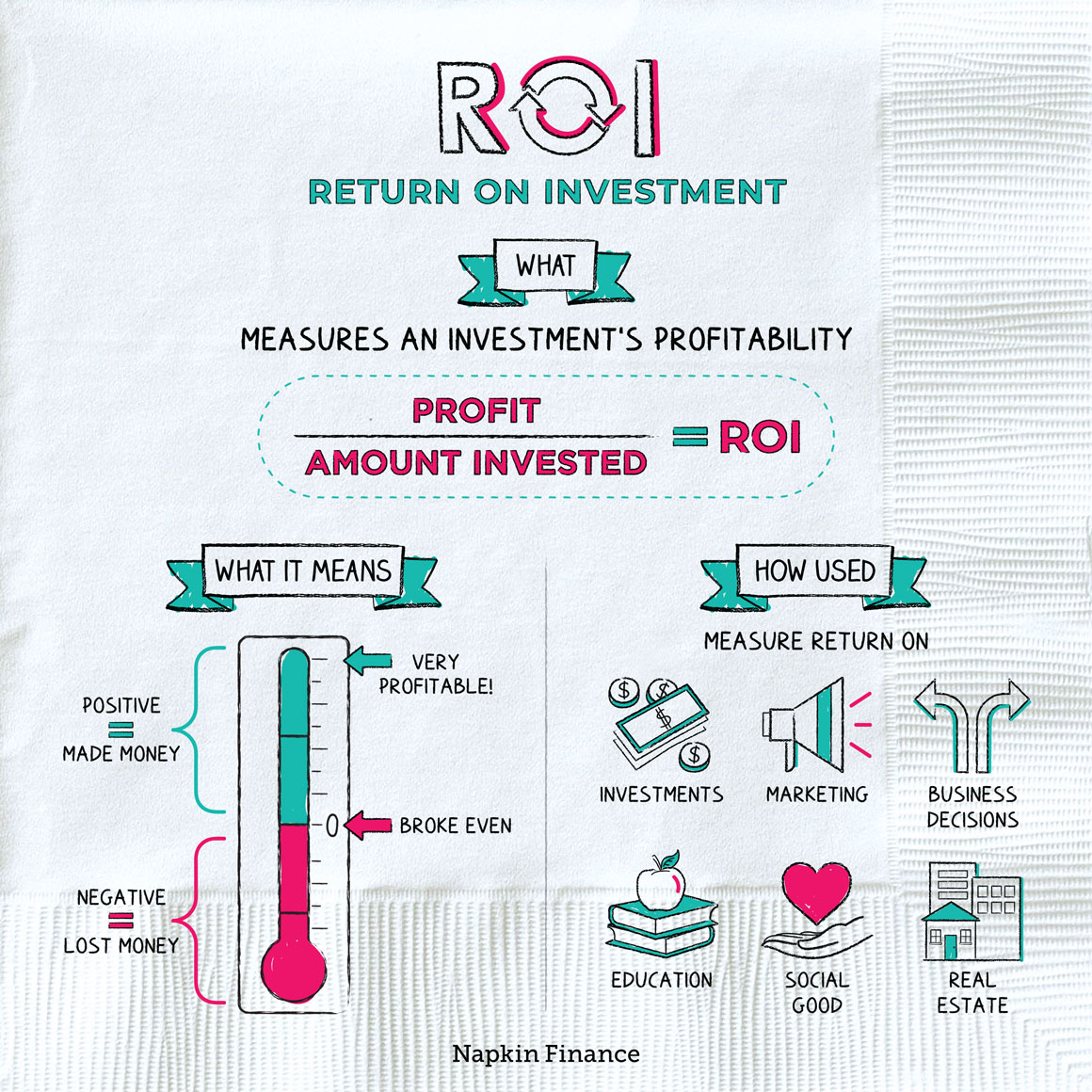

Roi Formula Calculate Roi And More From Napkin Finance

Return On Investment Definition Formula Roi Calculation

Calculating Return On Investment Roi In Excel

Return On Investment Definition Formula Roi Calculation

Return On Investment Definition Formula Roi Calculation